**There’s a link to a Budget Planner at the bottom of the blog post

For many, buying their first home is not just a transaction; it’s a significant milestone that symbolizes stability and achievement. However, the path to acquiring those keys can be fraught with financial hurdles and unexpected detours. The power of a monthly budget becomes your most reliable navigator in this journey, ensuring you reach your destination prepared and confident.

Understanding Your Financial Terrain

A monthly budget isn’t merely about tracking income and expenses; it’s about gaining a profound understanding of your financial landscape. This clarity is indispensable when stepping into the world of mortgages, down payments, and interest rates. It enables you to realistically assess how much home you can afford, preventing the common pitfall of falling in love with a property that stretches your finances too thin.

Saving for the Down Payment

The down payment often represents the first significant hurdle for first-time homebuyers. A disciplined budget can carve out a savings strategy, turning the dream of homeownership from a distant vista into an achievable reality. By identifying areas where you can cut back, a budget helps in accumulating the needed funds more efficiently, potentially securing better mortgage terms with a larger down payment.

Navigating Monthly Mortgage Payments

Your budget is your compass as you navigate the ongoing commitment of monthly mortgage payments. It ensures that beyond the mortgage, you can comfortably cover property taxes, insurance, maintenance, and unexpected repairs—key components of responsible homeownership that are often overlooked in the excitement of purchasing a new home.

Strengthening Your Loan Application

Lenders scrutinize your financial health when considering your loan application. A solid history of budgeting demonstrates fiscal responsibility, making you a more attractive candidate for a mortgage. It can lead to more favorable loan terms and interest rates, significantly impacting the total cost of your home over time.

Embracing Budgeting Tools

Fortunately, we live in an age where technology is a staunch ally in financial planning. Numerous apps and online tools are available to help you track spending, save for your down payment, and understand your purchasing power. Embracing these tools can simplify the budgeting process, making it more efficient and effective.

The Joy of Preparedness

Ultimately, the greatest power of having a monthly budget lies in the peace of mind it brings. Knowing you’re financially prepared to take on the responsibilities of homeownership allows you to enjoy the process and the outcome without the cloud of financial stress hanging over your new home.

In closing, while the idea of budgeting might seem daunting or restrictive, especially with the excitement of buying your first home, it’s truly the foundation upon which the joy and security of homeownership are built. Start your journey with a budget, and watch as the path to your dream home unfolds with clarity and confidence.

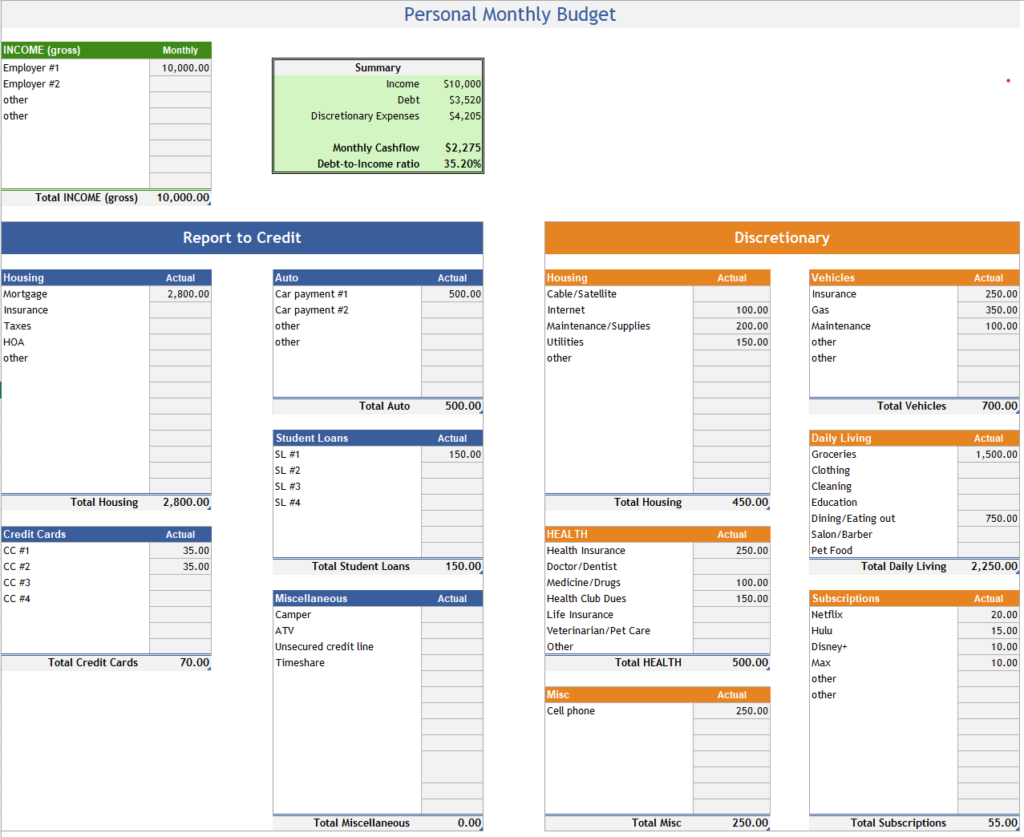

Screenshot of the downloadable Budget Planner (download link below):

Link to download the budget planner: co-mortgage.com/budget-planner/